Q2 2025 Staffing Industry M&A Activity Report

Q2 2025 Overview

Activity in the staffing M&A market during Q2 came in stronger than most expectations. Despite persistent macroeconomic headwinds such as sticky inflation, increasing geopolitical uncertainty, and unpredictability around future interest rate policy, the quarter saw 38 transactions announced, up from 32 in Q1.

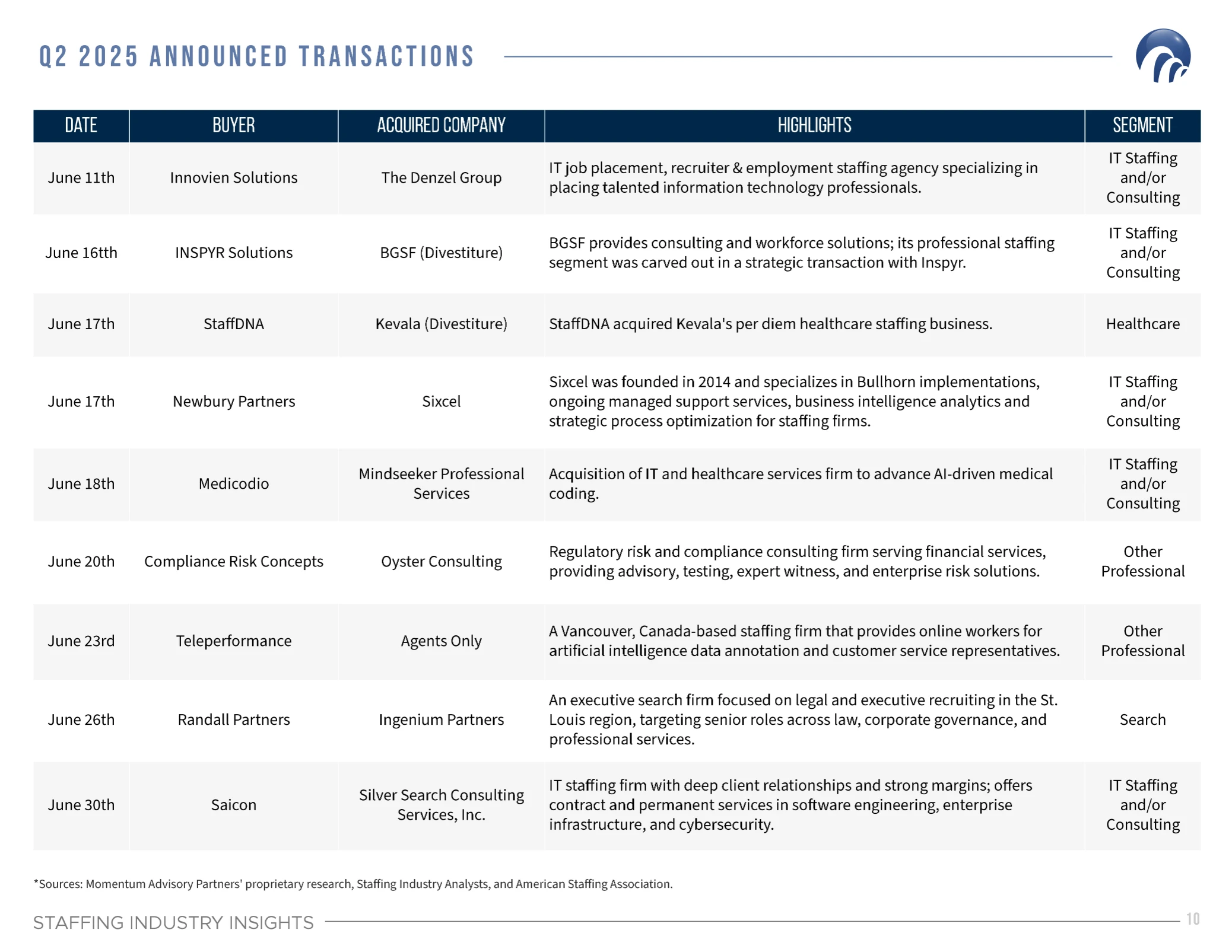

While the quarter included its fair share of smaller deals, there were also several large, high-impact transactions. Inspyr Solutions acquired BGSF’s professional staffing segment, a meaningful carve-out that reshapes BGSF’s strategic focus. AtkinsRéalis made a significant investment in David Evans Enterprises, adding depth to its engineering and technical consulting capabilities. Mainline’s acquisition of

Converge Technology Solutions stood out as one of the most substantial deals of the quarter, expanding its footprint in managed IT services and infrastructure. These transactions reflect that buyer appetite remains strong for scaled, strategically aligned platforms.

We also advised Silver Search Consulting Services, a respected IT staffing firm, on its sale to Saicon. What stood out during that process was the level of buyer competition. We received eight letters of intent, with many buyers citing the limited number of quality opportunities in the market. For firms experiencing slowing or stalled organic growth, acquisitions are becoming a necessary path forward. When the right asset becomes available, the result is a highly competitive process.

Sector-wise, IT staffing and healthcare remained the most active subsectors. Private equity involvement increased modestly, with five add-on acquisitions and one platform investment by financial sponsors completed in the quarter.

On the economic front, the latest U.S. jobs report came in well below expectations. In July, employers added just 73,000 jobs, and downward revisions to May and June data reduced job gains by a combined 258,000. These revisions brought the average monthly job growth for Q2 to approximately 35,000, the slowest pace outside of a recession since at least 2010. The unemployment rate ticked up to 4.2 percent. With this slowdown, expectations have increased for a potential interest rate cut by the Federal Reserve as early as September.

Given this backdrop, we remain cautious heading into the second half of the year. While staffing M&A activity has proven more durable than anticipated, sentiment can shift quickly. Future deal activity will continue to be shaped by broader economic conditions, access to capital, and the availability of high-quality companies coming to market.

Key Hightlights of Q2 2025

Deal Volume Exceeds Expectations

Q2 saw 38 announced transactions, marking an increase from 32 in Q1 and demonstrating continued activity despite broader macroeconomic pressures. Buyer engagement remained steady across strategic and financial segments.

Notable Large-Scale Transactions

Several high-impact deals shaped the quarter’s narrative, including Inspyr Solutions’ acquisition of BGSF’s professional staffing segment, Mainline’s acquisition of Converge Technology Solutions, and AtkinsRéalis’ investment in David Evans Enterprises. These transactions underscore that scaled, strategically aligned assets continue to attract strong buyer interest.

IT and Healthcare Lead Sector Activity

IT staffing and consulting accounted for the largest share of Q2 transactions, followed by healthcare staffing. Together, these two segments represented more than half of total deal volume for the quarter.

Momentum Transaction: Silver Search Consulting Services

Momentum Advisory Partners advised Silver Search Consulting Services on its sale to Saicon Consultants. Founded in 2000, Silver Search built a strong reputation in the IT staffing space through its specialized contract focus, experienced team, and mostly direct customer base. The deal reflects a strategic fit, giving Saicon a needed presence in the Northeast while bringing scale and infrastructure to Silver Search.

Private Equity Activity Returns

Financial sponsors re-engaged modestly, participating in six transactions: five add-ons and one new platform investment. While still below historical highs, this activity suggests a measured return of PE interest in staffing assets.

Comparative Analysis: Q2 2025 vs Prior Quarters

Quarter-over-quarter

M&A activity in Q2 held up well following a stronger-than-expected Q1. Transaction volume increased from 32 in Q1 to 38 in Q2. While not a dramatic jump, the consistency of deal flow through the first half of the year stands out — particularly in a market where economic signals have been mixed and buyer sentiment has remained cautious.

The mix of transactions also shifted slightly in Q2. Whereas Q1 saw a higher number of smaller platform and add-on deals, Q2 included a greater number of larger, more strategically significant transactions. Several buyers appeared to re-engage more aggressively, particularly in IT and infrastructure services.

Year-over-year

Compared to Q2 2024, which saw 34 transactions, Q2 2025 represented a modest uptick in activity. The difference was not just in deal count, but in composition. Q2 2024 was marked by a heavier weighting toward healthcare staffing and limited private equity involvement. In contrast, Q2 2025 saw stronger participation from IT services, a broader spread of deal types, and a small but noticeable return of private equity interest.

Buyer Profile and Behavior

Private equity was completely absent from Q4 2024, returned modestly in Q1 2025, and continued its measured re-entry in Q2 with six transactions. Strategic buyers remained the primary drivers of deal flow, but increasingly displayed a willingness to move quickly and competitively on high-quality assets. This was evident in several competitive processes, including the sale of Silver Search Consulting Services.

While overall M&A activity has not returned to pre-2022 levels, the first half of 2025 suggests that buyers—particularly those with strong balance sheets—are finding ways to be opportunistic. The consistency in volume and increase in transaction quality point to a market that, while still cautious, is more functional than it was at this time last year.

Transaction Volume

Sector Breakdown

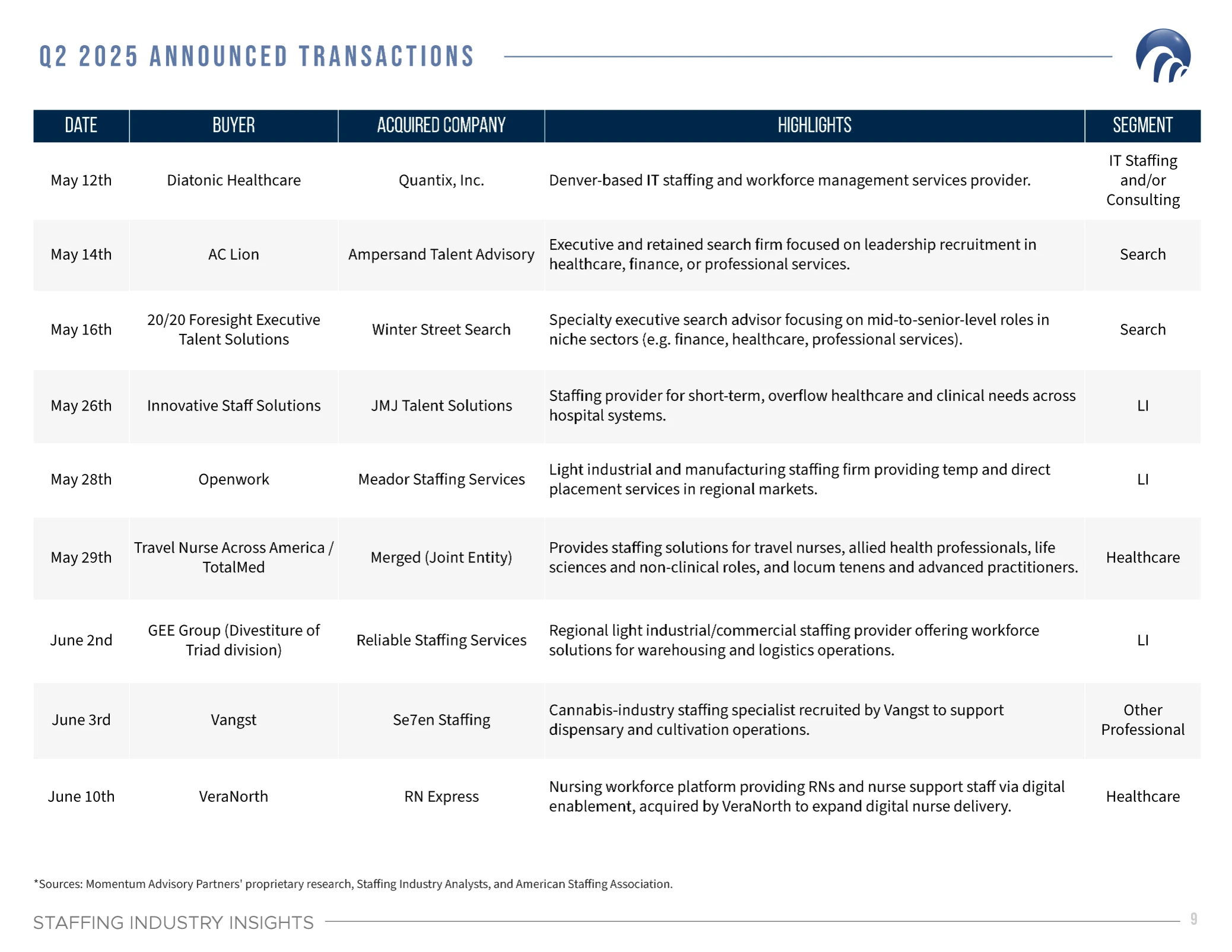

Q2 2025 deal activity was concentrated across a familiar mix of subsectors, with IT Staffing and Consulting and Healthcare Staffing once again accounting for the majority of transactions.

- IT Staffing and Consulting led all sectors with 12 transactions, reflecting ongoing demand for digital infrastructure, software development, cybersecurity, and consulting capabilities.

- Healthcare Staffing followed with 9 transactions, showing relative resilience despite broader softness in some healthcare delivery segments.

- Other Professional Staffing accounted for 8 transactions, encompassing areas such as finance, compliance, and education.

- Search activity remained steady, with 6 transactions involving retained and executive search firms.

- Light Industrial/Commercial Staffing activity was modest, totaling 3 transactions, consistent with prior quarters.

This distribution aligns with broader market themes. Buyers continue to target specialized providers with differentiated capabilities, particularly those aligned with secular growth areas like healthcare, life sciences, and enterprise IT transformation.

Notable Transactions: Q2 2025

Inspyr Acquires BGSF

Inspyr acquired BGSF’s professional staffing segment in a carve-out that significantly reshapes BGSF’s operating focus and gives Inspyr immediate scale in professional staffing.

Mainline Acquires Converge Technology Solutions

One of the largest transactions of the quarter, this acquisition enhances Mainline’s capabilities in cloud, data center, and managed IT services.

AtkinsRéalis acquires David Evans Enterprises

A notable investment that strengthens AtkinsRéalis’ position in engineering and technical services in North America.

Saicon acquires Silver Search Consulting Services

Silver Search Consulting Services, a New Jersey-based IT staffing firm known for its high-touch model and long-standing client relationships, was acquired by Saicon Consultants.

Q2 2025 Announced Transactions

About Momentum Advisory Partners

Momentum Advisory Partners is a leading M&A broker specializing in advising and representing founders of North American staffing companies in a sale. Founded in July of 2020 by Akash Taneja—who brings over 16 years of staffing M&A experience, including 12 years at a leading advisory firm — Momentum has quickly become a trusted partner for staffing founders considering an exit.