Q1 2025 Staffing Industry M&A Activity Report

Q1 2025 Overview

The staffing M&A market opened 2025 with a strong showing: 32 announced transactions, marking a notable uptick in both volume and quality compared to recent quarters. After several quarters dominated by smaller, add-on deals, Q1 saw a rise in more notable, larger-scale transactions—a welcome change that we highlight later in this report.

What’s more, this level of activity exceeded our expectations. While we anticipated a busier second half of the year, Q1’s deal flow was a pleasant surprise and suggests that buyers are increasingly prepared to re-engage earlier than expected. This sentiment is supported by our recent 2025 Staffing M&A Buyer Survey, where respondents indicated a sustained appetite for acquisitions—so long as quality opportunities come to market.

At the Staffing Industry Analysts’ Executive Forum in March, we heard a consistent message: buyer appetite remains strong, but the pipeline of high-quality deals remains limited. Many buyers shared that they’re actively looking, but they’re just not seeing the caliber of companies they want to invest in.

At Momentum Advisory Partners, we’ve experienced strong engagement and activity on the deals we currently have in market, which reinforces that demand is there when quality aligns with expectations.

Looking ahead, visibility is increasingly limited. The new tariffs implemented on March 9 by the Trump administration have introduced additional uncertainty into the market, compounding concerns already tied to inflation, interest rates, and geopolitical instability. Ultimately, the outlook for staffing M&A will be closely tied to the performance of the staffing industry itself, which in turn is heavily influenced by the broader economy and policy shifts.

Still, with a stronger-than-expected Q1 and clear interest among buyers, there’s reason for optimism—especially if macroeconomic conditions stabilize and quality deal flow improves.

Key Hightlights of Q1 2025

Stronger-Than-Expected Deal Volume

- Q1 saw 32 announced transactions, exceeding expectations and marking one of the most active quarters in recent memory.

Notable Strategic Transactions

- After a period dominated by smaller add-ons, Q1 featured several larger, strategic transactions, including deals by Akkodis, ASGN, and TrueBlue, all covered in greater detail later in this report.

High Interest in Active Deals

- Momentum Advisory Partners saw strong engagement across the deals we currently have in market, signaling healthy demand for quality assets.

IT and Healthcare Lead Sector Activity

- IT Staffing and/or Consulting accounted for the largest share of transactions, followed by Healthcare Staffing. These two segments continue to drive overall deal volume.

Private Equity Activity Rebounds

- Private equity involvement increased, with 8 of the 32 transactions involving PE-backed buyers—4 add-ons and 4 platform investments—a sign of cautious re-engagement by financial sponsors.

Quality Deal Scarcity

- Although buyer appetite was strong in Q1, many firms reported that high-quality acquisition targets remain difficult to find. This sentiment was echoed at the SIA Executive Forum and in our 2025 Buyer Survey, where several buyers noted they are ready to transact—but only when the right opportunities come to market.

Macroeconomic Uncertainty Increasing

- New tariffs introduced in March have added uncertainty to the economic outlook, raising potential headwinds for future deal activity.

Comparative Analysis: Q1 2025 vs Q4 2024

Quarter-over-quarter

- Transaction volume rose from 24 deals in Q4 to 32 deals in Q1, signaling growing momentum.

- Larger, more strategic transactions returned in Q1, contrasting with the smaller, incremental deals of Q4.

- Private equity activity rebounded meaningfully after a complete absence in Q4 2024.

Year-over-year

- Transaction volume increased significantly from 24 transactions in Q1 2024 to 32 in Q1 2025 (60% YoY growth).

- Healthcare staffing, which was absent in Q1 2024, returned as a strong contributor in Q1 2025.

- Private equity transactions also increased year-over-year, from 6 to 8.

Transaction Volume

Notable Transactions: Q1 2025

While deal volume in Q1 2025 was strong, what made the quarter particularly noteworthy was the return of larger, strategic transactions. After several quarters dominated by smaller add-ons, Q1 featured a number of meaningful acquisitions that stood out in both scale and strategic impact. Below, we highlight three such transactions that helped shape the quarter’s narrative.

ASGN Acquires TopBloc

In February 2025, ASGN Incorporated announced the acquisition of TopBloc, a high-growth, tech-enabled Workday consultancy, for $340 million. The deal positions ASGN as a key player in the Workday ecosystem and is expected to contribute $150 million in 2025 revenue.

TrueBlue Acquires Healthcare Staffing Professionals

In January 2025, TrueBlue completed its acquisition of Healthcare Staffing Professionals (HSP), expanding its footprint in the healthcare staffing segment. The acquisition supports TrueBlue’s strategy of growth through diversification into high-demand verticals.

Akkodis Acquires Ral and Compliance Partners

In January 2025, Akkodis, a global digital engineering company and part of The Adecco Group, acquired Raland Compliance Partners, a U.S.-based provider of quality and regulatory compliance services to the Life Sciences industry. This acquisition enhances Akkodis’ consulting services footprint and expertise in the Life Sciences & Healthcare sector, enabling it to deliver greater innovation and scalability to clients worldwide.

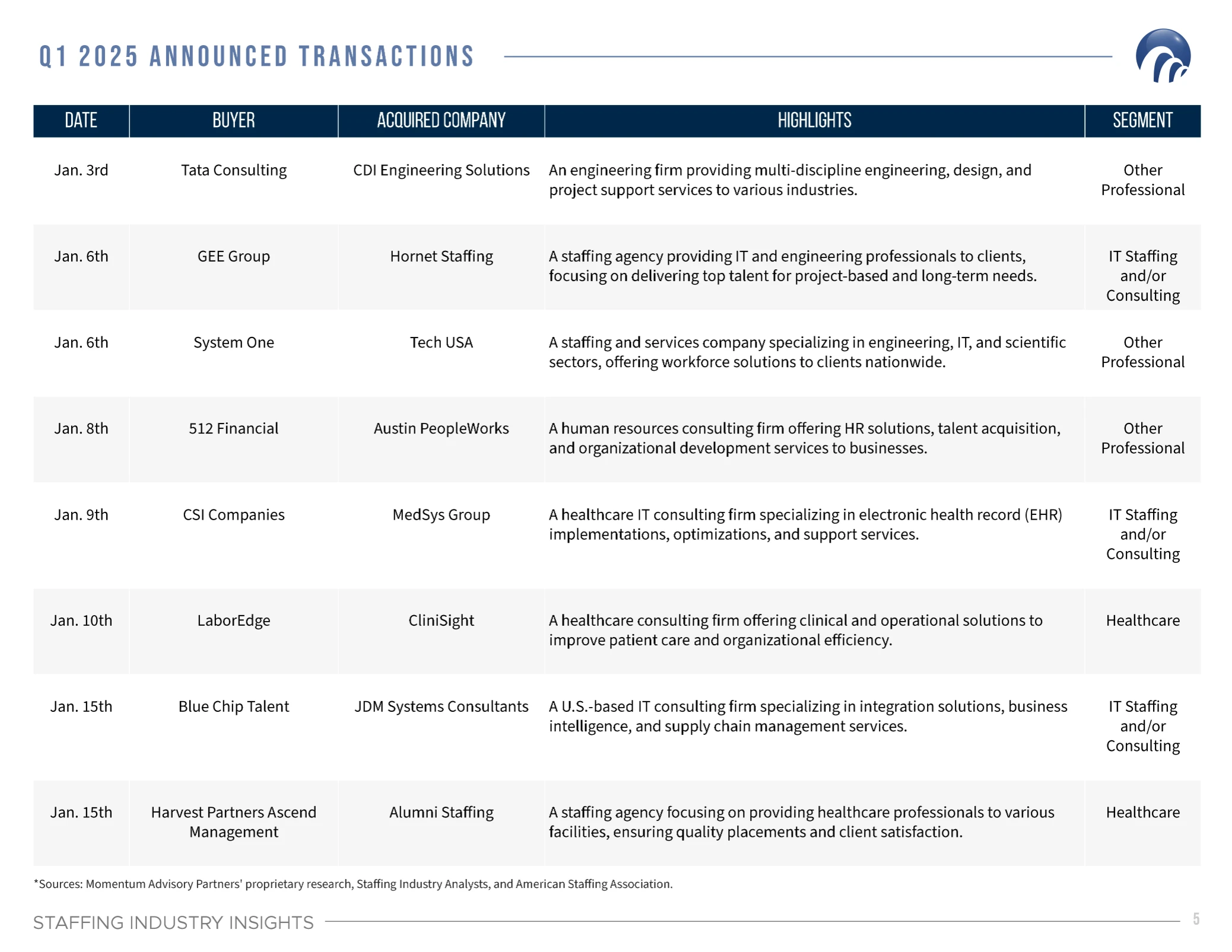

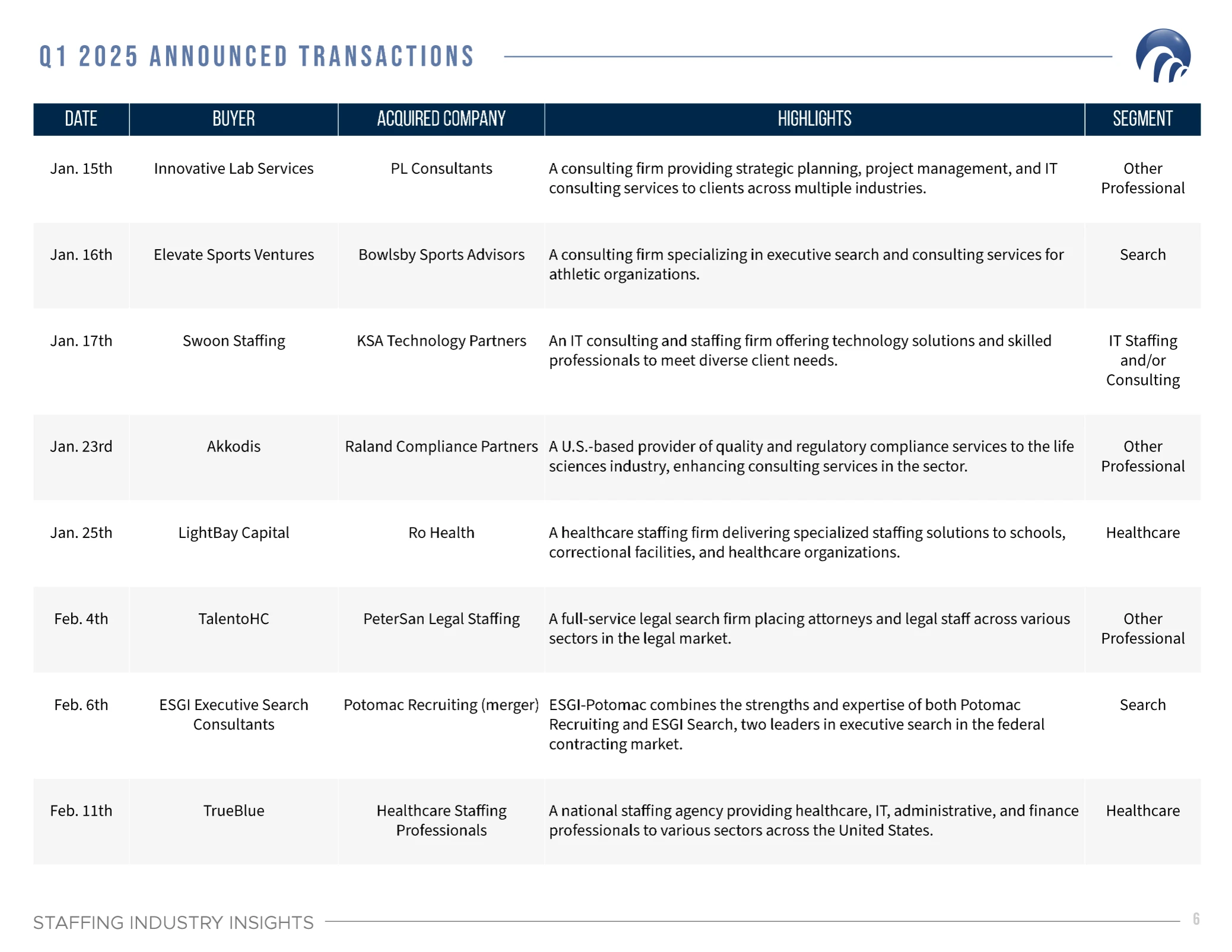

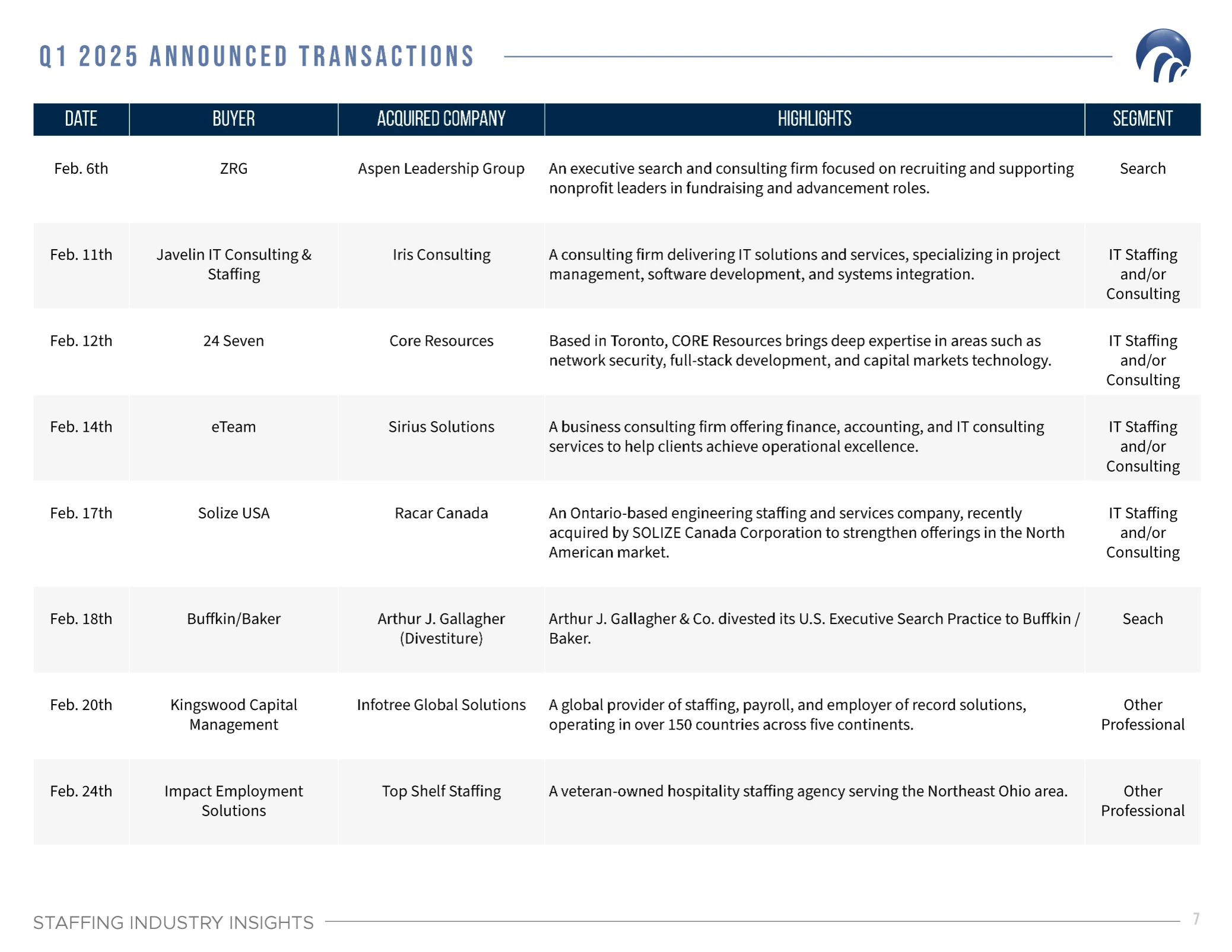

Q1 2025 Announced Transactions

About Momentum Advisory Partners

Momentum Advisory Partners is a leading M&A broker specializing in advising and representing founders of North American staffing companies in a sale. Founded in July of 2020 by Akash Taneja—who brings over 16 years of staffing M&A experience, including 12 years at a leading advisory firm — Momentum has quickly become a trusted partner for staffing founders considering an exit.