2025 Staffing Industry M&A Activity Report

2025 Overview

Key Hightlights of 2025

1. Transaction Volumes:

- North American staffing M&A activity totaled 111 announced transactions in 2025, a slight increase from the 102 deals recorded in 2024.

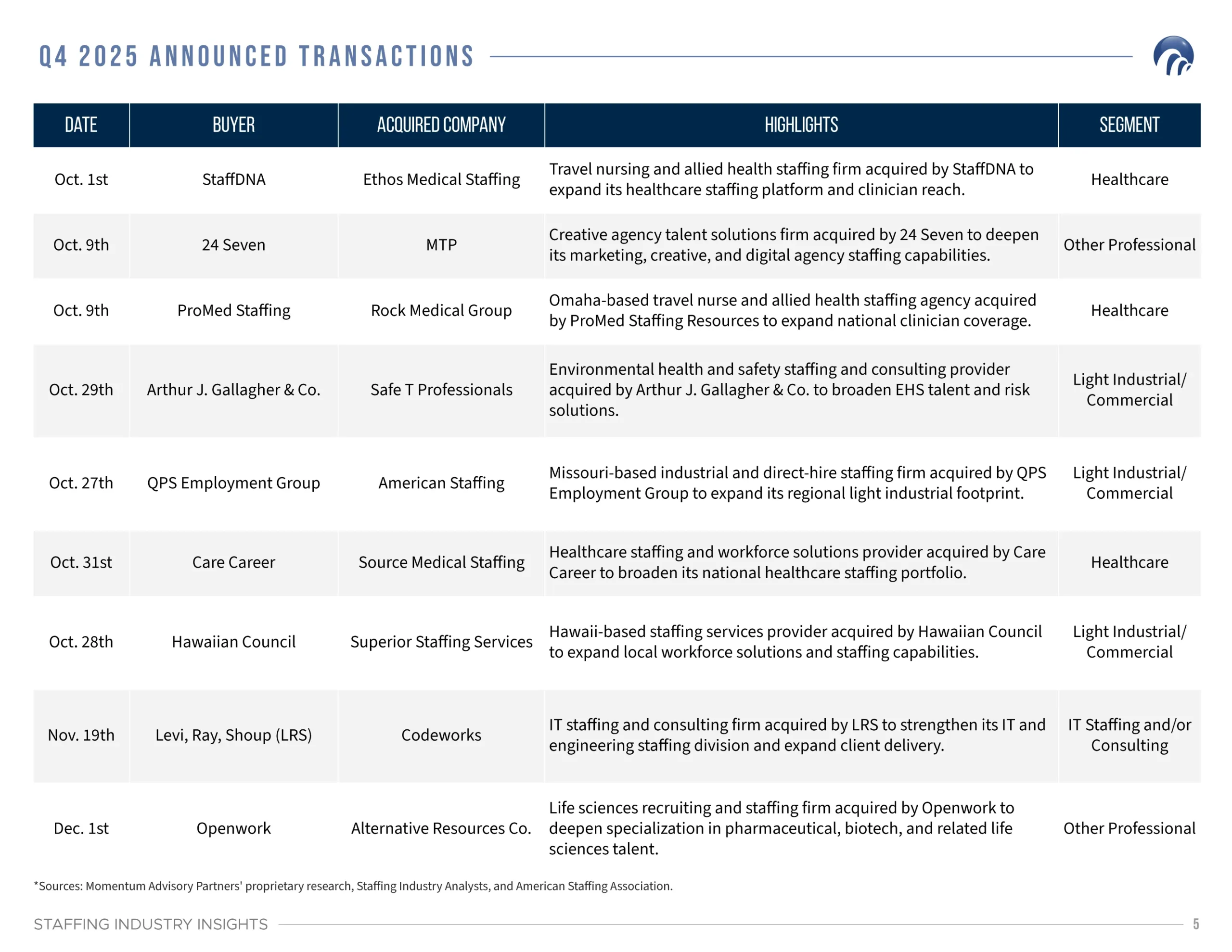

- Quarterly activity was uneven, with Q2 remaining the high watermark for the year with 38 transactions. Q3 and Q4 each recorded just 16 and 25 transactions, respectively.

- Despite the year-over-year increase, the majority of deals in 2025 were smaller, non-competitive transactions, suggesting a “buyers” market.

2. Market Sentiment:

- The broader staffing market remained under pressure, with industry revenue contracting in 2025.

- Many continue to postpone plans for a sale, citing suboptimal financial performance, limited buyer interest, or a belief that stronger results would yield better valuations in the future.

3. Sector Activity:

- IT Staffing and/or Consulting continued to represent a significant share of total volume, accounting for 32 of the 111 total transactions.

- Healthcare Staffing was the second most active segment with 22 transactions, up slightly from 19 in 2024.

- Light Industrial and Commercial Staffing was the worst performing segment with just 13 transactions in the

4. Private Equity Activity:

- Financial sponsor involvement remained muted, with relatively few deals showing direct PE backing.

Comparative to 2024

While headline volume showed modest growth, the quality and size of transactions continued to reflect a weak M&A environment:

- 2024 included more available assets for sale with select PE involvement and larger transactions.

- 2025 volume ticked up to 111 transactions, but activity was dominated by small, discounted, and largely unrepresented deals.

- Buyers reported a continued lack of quality inventory, with many founders unwilling to sell in a down market.

While volume appeared healthy on paper, the M&A market in 2025 remained challenged. Most transactions were smaller, unrepresented, and discounted. Until there is meaningful improvement in broader staffing industry performance, M&A activity is expected to remain subdued.

Q4 2025 Overview

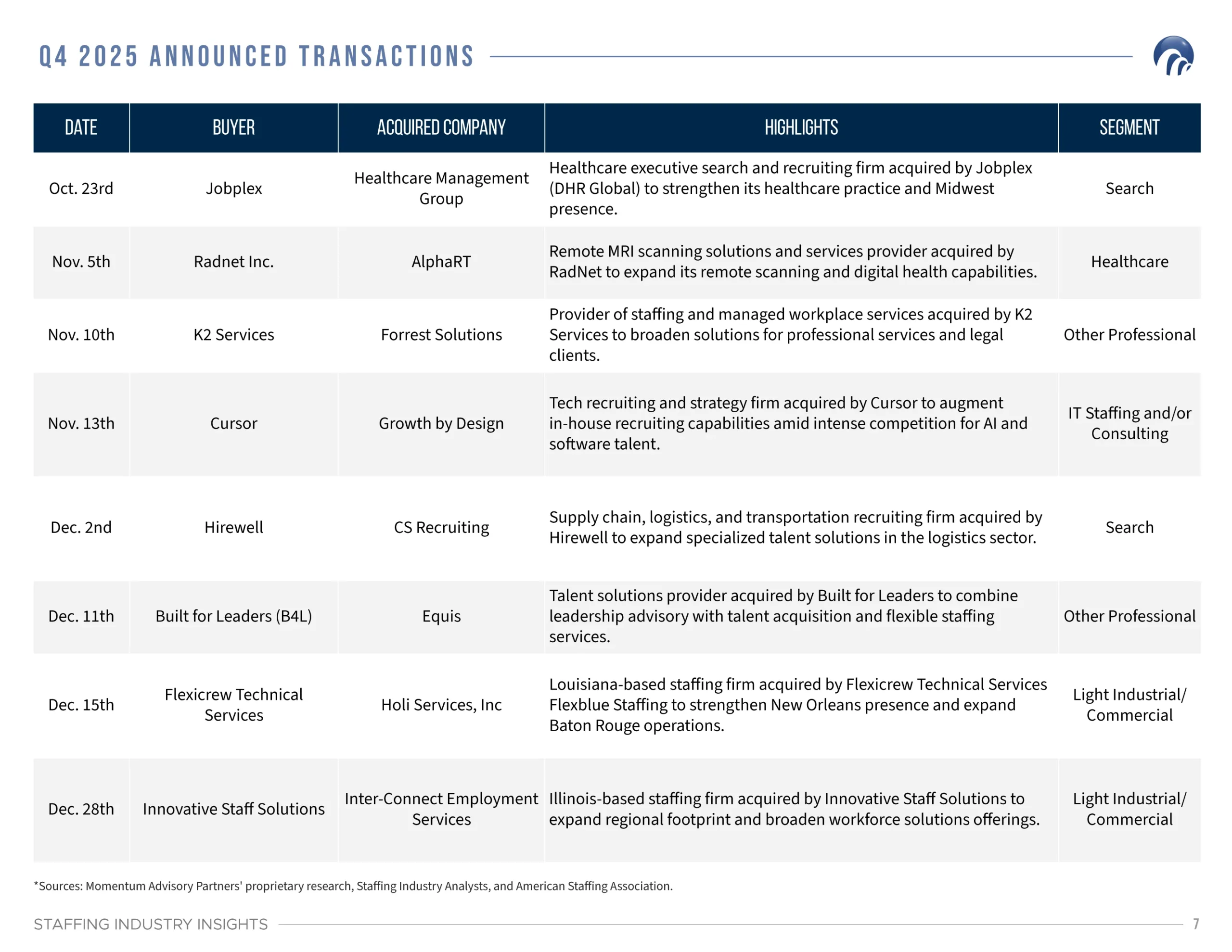

In Q4 2025, North American staffing M&A activity totaled 25 announced transactions, up from 16 in Q3. Deal activity remained consistent with broader 2025 trends: subdued, fragmented, and largely composed of smaller strategic acquisitions.

Heidrick & Struggles Take-Private Transaction:

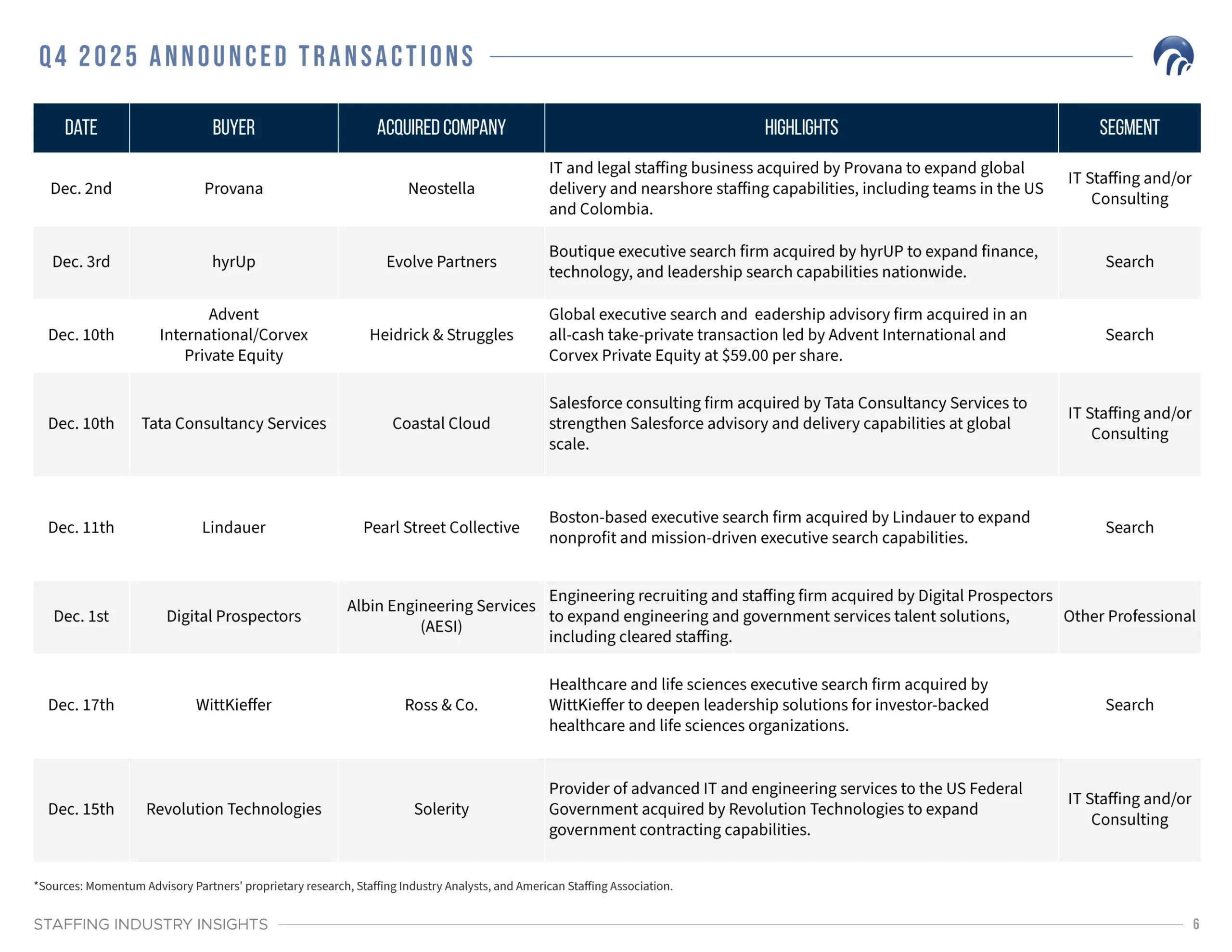

In October 2025, Heidrick & Struggles entered into a definitive agreement to go private in an all-cash transaction led by an investor consortium headed by Advent International and Corvex Private Equity, with shareholders to receive $59.00 per share. The transaction valued Heidrick & Struggles’ equity at approximately $1.3 billion and closed on December 10, 2025, making it one of the few large-scale, sponsor-led transactions to complete during the year.

Lack of Available Deals:

Q4 reinforced how constrained the sell-side remains. Buyers reported limited exposure to marketed, competitive processes, with many transactions occurring quietly and at the smaller end of the market. In this environment, buyers are increasingly selective, and high-quality opportunities stand out quickly when they do surface.

Ongoing Decline in Private Equity Activity:

While Heidrick’s buyer was a financial sponsor, the broader quarter reflected sustained caution from the private equity community. Q4 2025 once again saw limited participation from PE firms, with most activity driven by strategic buyers pursuing add-on acquisitions rather than platform investments.

2026 Outlook

We are now entering a third consecutive year of what I expect will be a cautious environment for M&A in the North American staffing industry. The reality is there is a lack of available “attractive” assets in the market. It is no coincidence that many of the most active strategic acquirers of the past several years have been largely on the sidelines. Buyers remain disciplined and hesitant to overextend on valuation, particularly in a market where performance has been exceptionally difficult to predict. Sellers, on the other hand, are reluctant to come to market until their businesses have stabilized or recovered to 2021/2022 levels. Many are simply choosing to wait it out.

Akash Taneja

Predictions for 2026

- I believe 2026 will be the year more would-be sellers “throw in the towel” and decide they are unwilling to wait out another year.

- The total number of transactions completed will marginally exceed 2025. However, consolidation will continue to be driven among smaller staffing firms.

- Buyer selectivity will remain high. Buyers will continue to prioritize assets that are clearly differentiated, resilient, and strategically aligned, rather than taking chances on “maybe” fits.

That said, for staffing companies that are outperforming the broader industry and considering a sale, there is still a strong market. Buyer deal flow remains light, and many of the opportunities they are seeing are not compelling. That is a favorable setup for high-quality firms to stand out and command strong interest. Buyers will be aggressive with valuations and deal structure with this cohort.

A broader resurgence in M&A activity still hinges on the overall performance of the staffing industry. Most industry forecasts point to only modest growth in 2026, and it is worth noting that these same forecasters have revised their estimates downwards in each of the past two years. Until we see a steadier flow of more meaningful transactions, it will be hard to say the staffing M&A market is truly “back.”

Q4 2025 Announced Transactions

About Momentum Advisory Partners

Momentum Advisory Partners is a leading M&A broker specializing in advising and representing founders of North American staffing companies in a sale. Founded in July of 2020 by Akash Taneja—who brings over 16 years of staffing M&A experience, including 12 years at a leading advisory firm — Momentum has quickly become a trusted partner for staffing founders considering an exit.